Amount Due to Director Journal Entry

This is because the company has already serviced this order in terms of processing the relevant goods and services. However the statement of cash flows will not show the 250000 dividend as it has not been paid yet.

General Journal In Accounting Double Entry Bookkeeping

1 Home DR Home CR Home Balance BALANCE.

. Goods are denoted as Purchases Ac when goods are purchased and Sales Ac when they are sold. For a normal company this excess balance will remain in the retained earnings. For example suppose a business has an amount of 1000 owed by a customer for services provided on account but also has an amount of 200 due to a supplier in this case the customers business for goods it has purchased.

Partners Current Ac to be credited if capitals are fixed in nature. 100000 x 30 30000. Credit that is due from customers is considered to be a current asset.

To Partners CapitalCurrent AC. On 31 January they pay a salary expense of 11000. Please prepare the journal entries for the remuneration package.

Step 1 Journal entry for salary due. Official Site Run Your Whole Business. Ends up paying less PAYENIC.

Event - it is a consequence or result of the transaction. Step 2 Transferring partners salary to Profit Loss Appropriation Ac. The journal entry is debiting a net income 100000 and a credit partner account 100000.

Purchase sale etc. As the company makes payment at the end of the month so they can make journal entry by debiting salary expenses and credit cash of 11000. Your company end-of-year is 31 st March 2021.

Answer 1 of 6. Goods are those items in which a business deals. The amount due from the customer has been posted to the accounts receivable ledger whereas the amount due to the supplier is.

If the company wants to distribute to the partner the needs to allocate the profit to each partner account. On 20 April the company has made a payment of 50000 to all directors. Say if his normal net pay is 1000 co will pay him 900100 so he is not losing out.

Goods Account is classified into five different accounts for. The amount needs to be paid back in 15 days. Hence no cash is involved here yet.

Transaction -any economic activity which results into change in financial position of the entity. Please prepare the journal entry for the January salary expense. Journal entries for Director loan write off.

The amount due from the customer has been posted to the accounts. Journals are as follows. It increases from prior month due to new staffs.

Firstly to understand this U should know the difference between transaction and event. Amount due from director double entry. Under the accrual method of accounting the above transaction will be.

The journal entry is debiting salary expense of 50000 and credit salary payable 50000. AMOUNT DUE TO DIRECTOR Date Journal Type 01-01-0001 Ref. On 20 April the company has made a payment of 50000 to all directors.

On 01 April the remuneration committee decide to pay the 10000 to each director. Journal Entry For Director S Remuneration Accountingcapital Chapter 15 Company Accounts. However due to the payment process and cash flow issue the payment is delayed.

The amount that is due from customers is also referred to as Accounts Receivable. With this journal entry the statement of retained earnings for the 2019 accounting period will show a 250000 reduction to retained earnings. If he takes a salary from the co pay him the normal salary less the grossed-up amount of woffso co.

A contra entry journal is used to make the adjustment. Partners Capital Ac to be credited if capitals are fluctuating. Company 2 will record the sale as due from account and Company 1 will record the purchase in the due to account as they have yet to pay Company 2.

View Amount due from directorpdf from ACCOUNTING BBSA4103 at Open University Malaysia. Accounting Treatment and Journal Entries for Credit due from Customers. Company 1 purchases goods from Company 2 on account credit.

In other words goods are the commodities that are purchased and sold in a business on a daily basis.

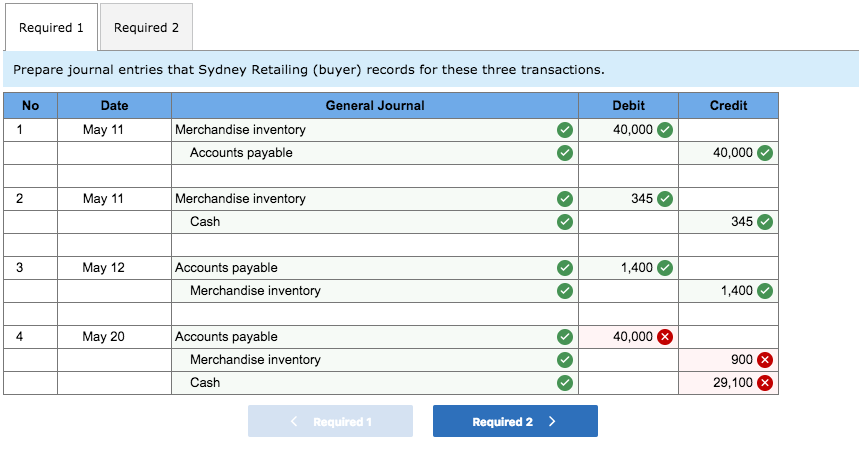

Solved Journal Entry Worksheet 2 3 4 Sydney Pays Troy Chegg Com

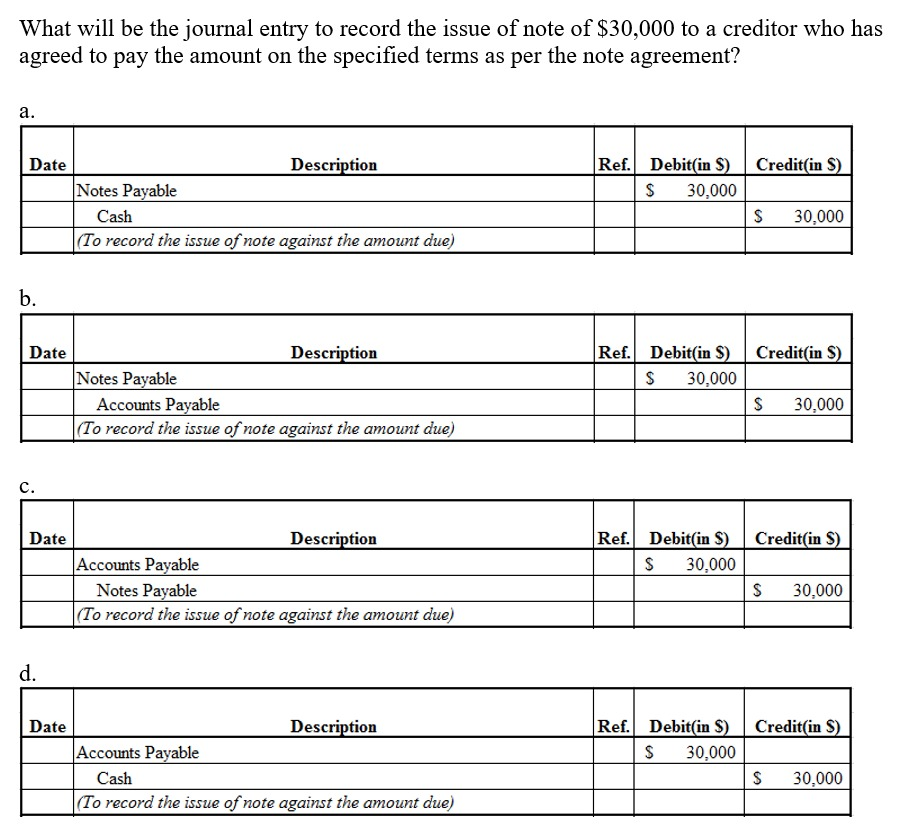

Solved What Will Be The Journal Entry To Record The Issue Of Chegg Com

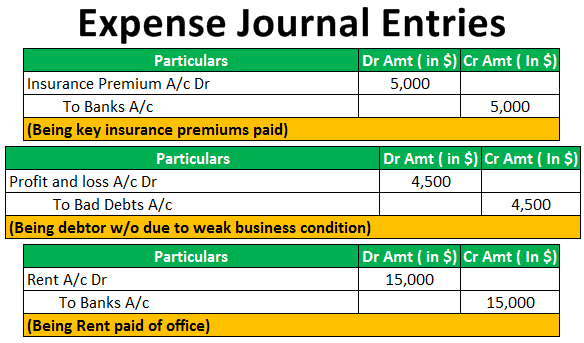

Expense Journal Entries How To Pass Journal Entries For Expenses

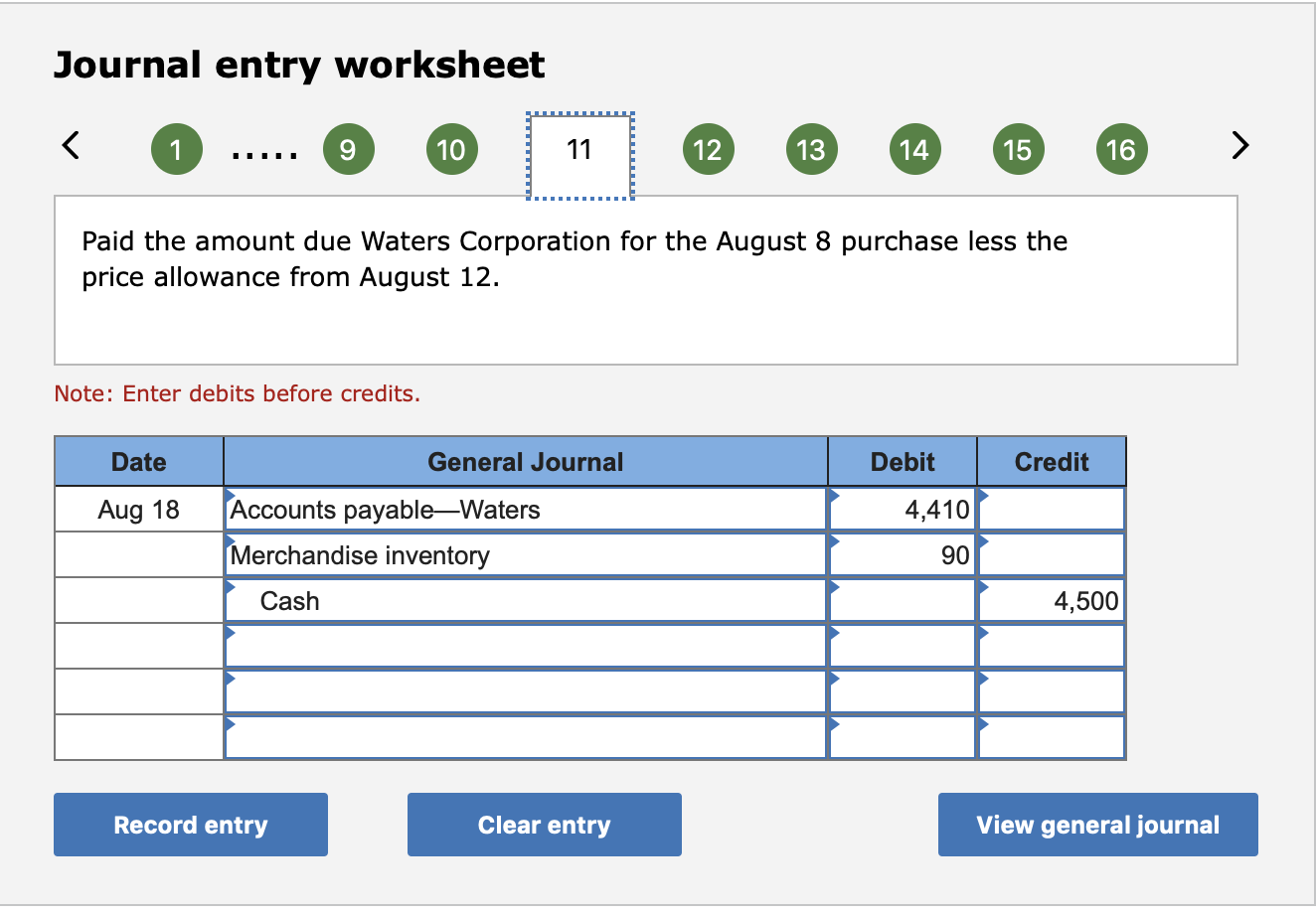

Solved Prepare Journal Entries To Record The Following Chegg Com

Insurance Journal Entry For Different Types Of Insurance

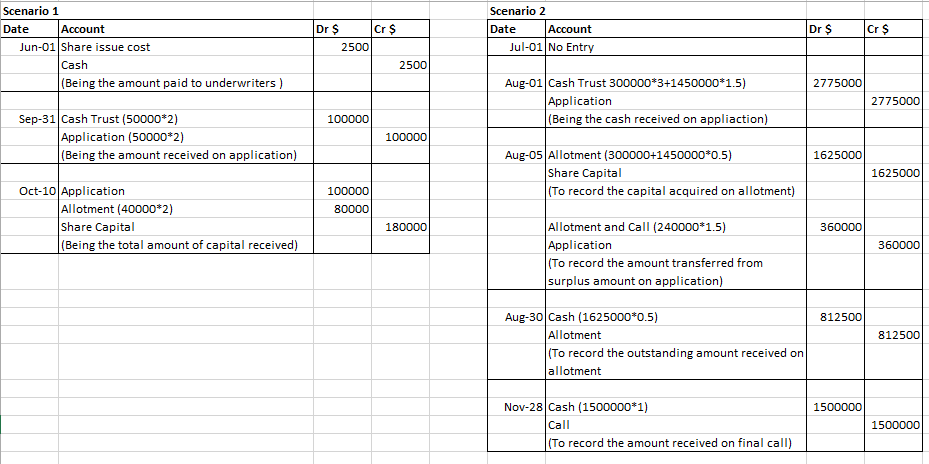

The Directors Decided To Offer 150 000 Ordinary Chegg Com

0 Response to "Amount Due to Director Journal Entry"

Post a Comment